The landscape of B2B purchasing is undergoing a rapid transformation, with digital channels becoming increasingly essential for successful business transactions and relationships. Today’s B2B buyers no longer settle for clunky, outdated digital experiences; they expect sophisticated, seamless interactions that mirror the convenience of B2C platforms while still handling the inherent complexities of business purchasing.

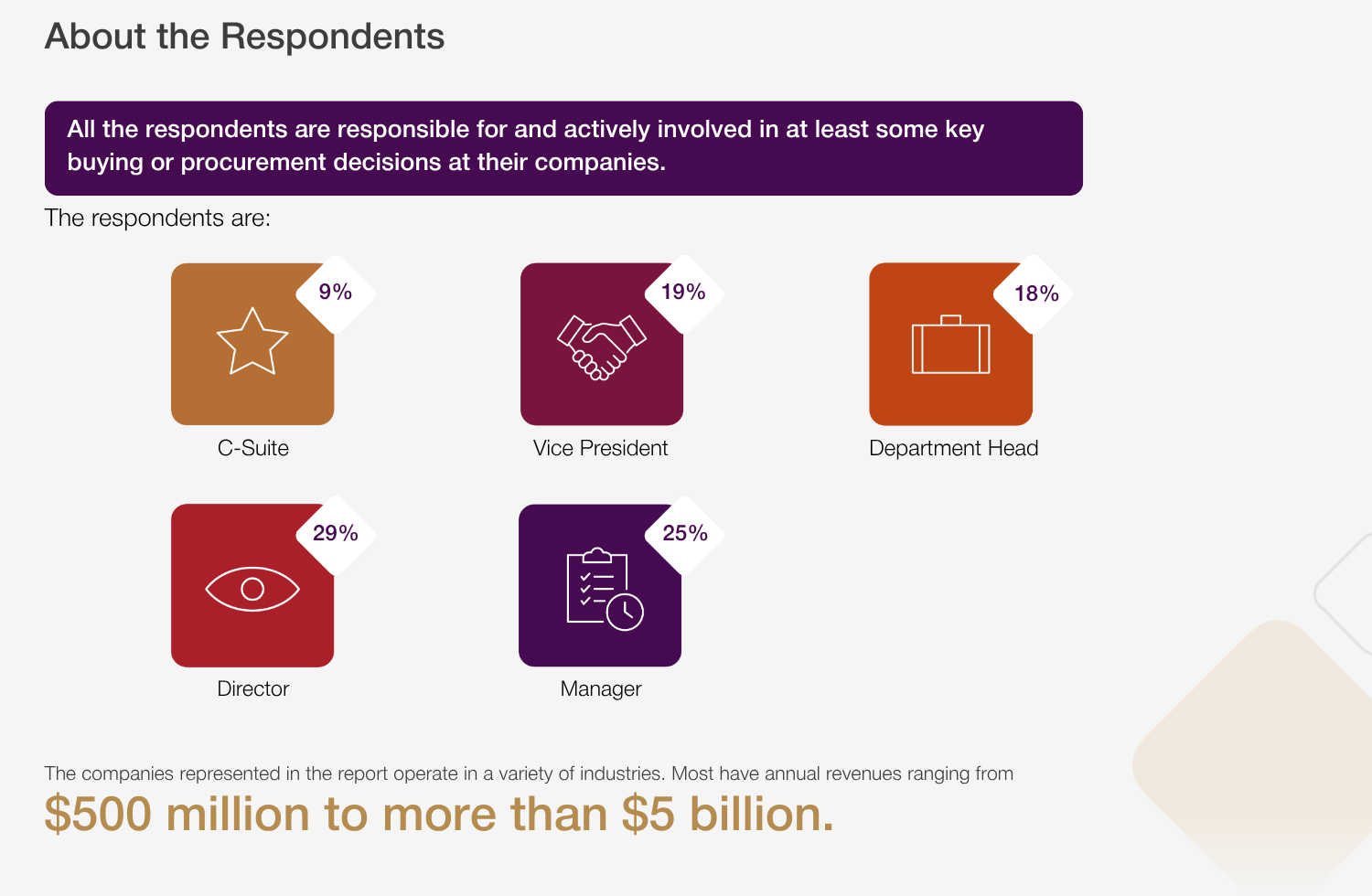

A recent report, “B2B Buyer Perspectives on the Future of Online Purchasing,” offers critical insights into the evolving expectations, challenges, and preferences of B2B buyers across various industries. Based on comprehensive survey data, the report reveals significant opportunities for B2B suppliers to enhance their digital offerings and drive customer satisfaction and loyalty. The respondents are involved in key buying or procurement decisions at companies, mostly with annual revenues ranging from $500 million to over $5 billion.

Digital is the Present and Future of B2B Purchasing

The data clearly shows that digital purchasing is not only well-established but also poised for continued growth. A significant majority of B2B buyers surveyed (67%) report making between 50-74% of their purchases using digital channels over the past 12 months, indicating that digital is already the standard approach for most procurement activities.

This trend is expected to accelerate, with 76% of respondents expecting the percentage of digital purchases to increase somewhat over the next 12 months, and an additional 7% anticipating a significant increase. This projected growth underscores the critical importance for B2B suppliers to continually refine and enhance their digital purchasing experiences.

The Satisfaction Gap and Key Areas for Improvement

Despite the high adoption of digital channels, the report highlights a notable satisfaction gap. 45% of respondents express dissatisfaction with current digital buying experiences. While 55% express at least some satisfaction (including 6% who are very satisfied), a significant 40% are “not very satisfied” and 5% report no satisfaction at all. Many B2B digital commerce experiences simply fall short of buyer expectations, especially when compared to consumer eCommerce.

Dissatisfied buyers provided clear feedback on where vendors can improve:

• Transparency and Communication: Buyers emphasized the need for delivery estimates and shipping timelines to be communicated before placing an order. Real-time, simple, and responsive communication channels are crucial for issues like order delays or price changes.

• Payment Flexibility and Security: Buyers want multiple payment options that are both safe and secure. Suppliers should diversify their payment solutions while ensuring robust security measures. 46% prioritize secure gateways, invoice visibility, and unified invoicing/payment management.

• Streamlined Order Management: Buyers desire a single dashboard to manage all orders, quotes, and invoices, eliminating the need to jump between emails and PDFs. Consolidating order management into a unified dashboard is a key suggestion for improvement. • Omnichannel Consistency: Digital channels should be connected, allowing buyers to start an order online and finish it easily across web or mobile devices. Buyers consider omnichannel consistency critical.

Tools and Capabilities Buyers Value

The survey data reveals clear preferences for specific capabilities that enhance the digital buying experience. Among the most frequently utilized digital tools when available:

• Multiple payment options (36% “always” use).

• Digital access to sales representatives (33% “always” use).

• Real-time inventory information (30% “always” use).

• Accurate product information, categorization, and pricing details (28% “always” use).

These patterns indicate that while self-service is valued, buyers still require access to detailed information and expert guidance for complex purchases. Personalization features also show strong adoption. Automated, personalized messaging triggered by online buying activity is used “always” or “often” by 78% of respondents when available. Similarly, streamlined, AI-enabled ordering from emailed PDFs is used by 72% of respondents. Automated product rankings and recommendations based on buyer history (68%) and custom visual merchandizing (67%) are also frequently used. Investing in AI and personalization technologies that can analyze buyer behavior and customize the purchasing experience is critical.

The State of Mobile and Integrated Platforms

B2B buyers are increasingly using mobile devices for purchases. However, only 4% are “very satisfied” with their mobile buying experiences, with 80% being only “somewhat satisfied”25. Pain points contributing to mobile disappointment include non-intuitive user interfaces (highly disappointing for 56% of dissatisfied mobile users), security and flexibility concerns in mobile payments (highly disappointing for 38% of dissatisfied mobile users), and lack of mobile optimization for product configurators (highly disappointing for 31% of dissatisfied mobile users).

Despite current limitations, the future of mobile B2B purchasing is positive, with 85% of respondents expecting the average value of their mobile B2B purchases to increase somewhat over the next 12 months, and 4% expecting a significant increase.

Crucially, buyers prioritize integrated buying platforms. Almost three-fourths (74%) say it is somewhat important, and 25% say it is very important, to have a single platform where they can place orders, view invoices, and make payments. Fragmented systems are no longer acceptable.

When evaluating unified payment platforms, the most important features identified (each prioritized by 46% of participants) are:

• Integrated invoicing and payment management that reduces manual effort.

• Secure payment gateways with features like PCI DSS compliance and fraud protection.

• Comprehensive invoice visibility showing available invoices, associated orders, and payment statuses… These capabilities are considered foundational requirements.

Creating B2B Buying Experiences That Stand Out

To enhance the B2B buying experience, suppliers should focus on proactive support, transparency, and tailored solutions offering personalization and flexibility. Buyers value real-time communication, technical expertise, streamlined processes, personalized service, flexible payment/shipping, and dedicated points of contact.

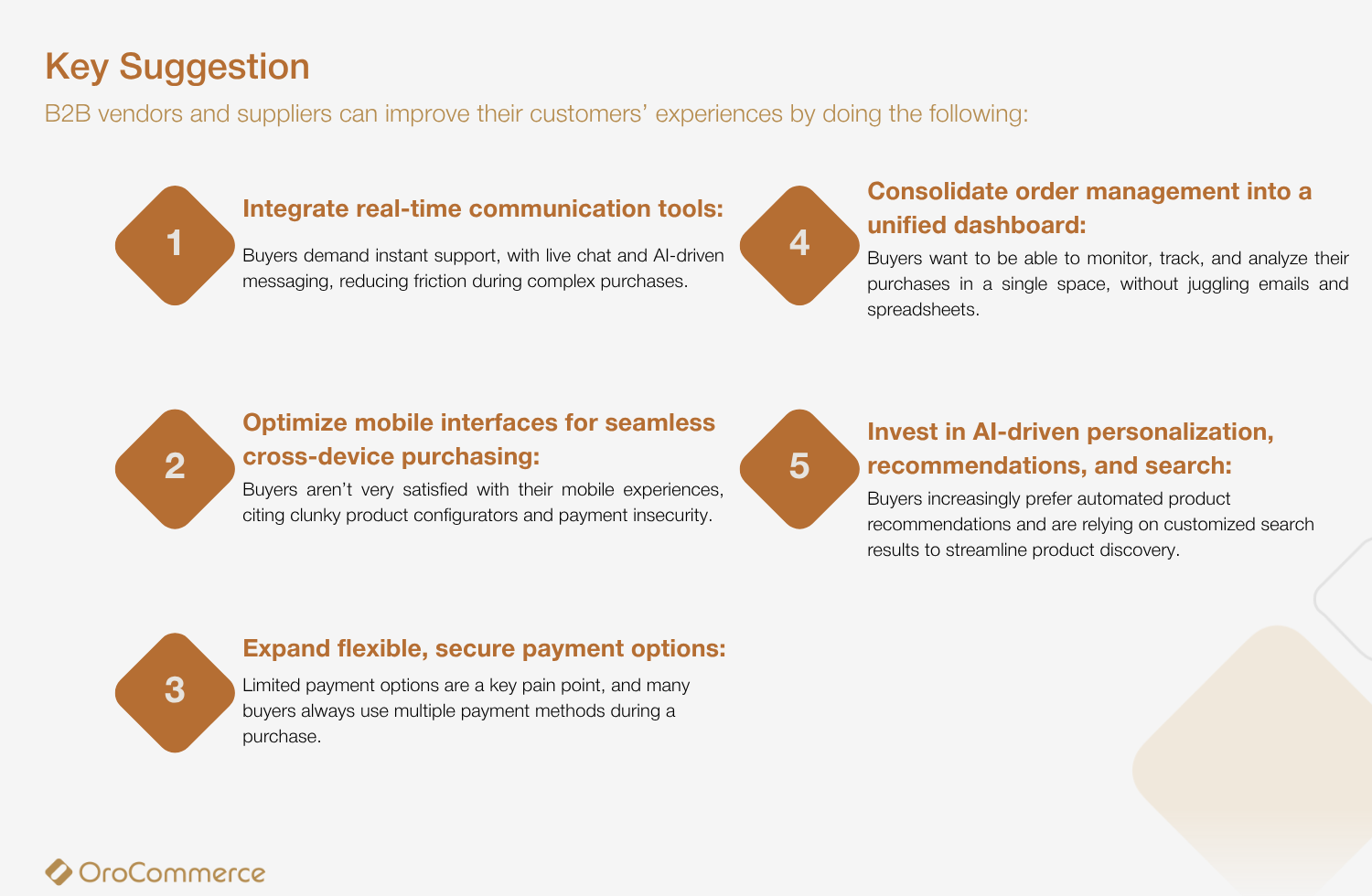

Key suggestions from the report include:

• Integrate real-time communication tools.

• Optimize mobile interfaces for seamless cross-device purchasing.

• Expand flexible, secure payment options.

• Consolidate order management into a unified dashboard.

• Invest in AI-driven personalization, recommendations, and search.

By prioritizing these areas, suppliers can foster long-term loyalty and position themselves as indispensable partners.

Investing in integrated digital ecosystems is essential for meeting customer expectations and remaining competitive. Addressing these key pain points will enhance customer satisfaction and loyalty In summary, navigating the evolving B2B e-commerce landscape requires a proactive and buyer-centric approach. By prioritizing transparency, flexibility, integrated digital tools, and personalized experiences, suppliers can close satisfaction gaps and build strong, lasting relationships with their customers. The insights from this report offer a clear roadmap for businesses to not only meet but exceed the expectations of modern B2B buyers, ensuring growth and success in the digital age.